Buy Now, Pay Later (BNPL) tools aren’t just a convenience anymore. They’ve become an expected part of the checkout experience. Shoppers use them to split payments into interest-free installments, which makes higher-value purchases more manageable. If your site doesn’t offer BNPL yet, that gap could be costing you.

BNPL Use Is Growing Fast Across All Demographics

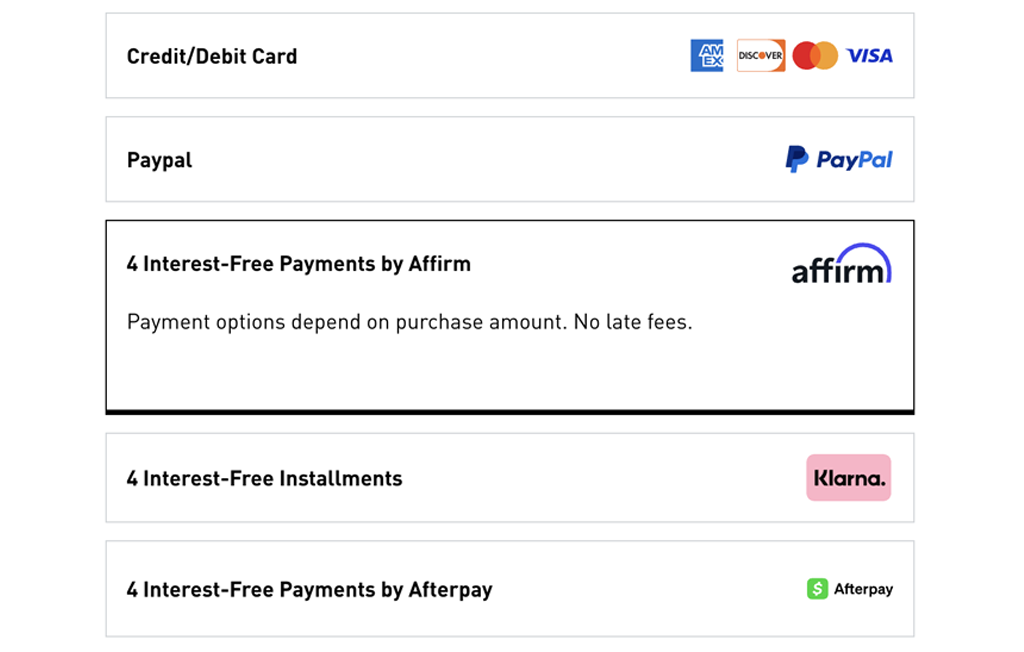

According to Bankrate, 30% of U.S. adults have used a Buy Now, Pay Later service. PayPal’s Pay in 4 leads at 15%, followed by Affirm at 11%, with Afterpay and Klarna each at 9%. Usage doesn’t depend on income. From budget-conscious shoppers to high earners, the demand for flexible payments is now a baseline expectation.

Why It Matters for Checkout

For first-time buyers, BNPL removes just enough hesitation to help them commit. For returning customers, it enables larger purchases and repeat buys without needing constant discounts. This has big implications for brands investing in SEO, paid search, and email. Even strong campaigns can fall flat if checkout doesn’t support how people expect to pay.

Yes, Processing Fees Can Be Higher (But So Are Returns)

Some retailers hesitate to offer BNPL because of its higher per-transaction cost compared to credit cards. But those costs don’t exist in a vacuum. When BNPL leads to higher conversion rates, stronger repeat behavior, and increased average order value, it pays for itself quickly. The bigger risk? Spending thousands on traffic, only to lose customers at the final step.

What Starkmedia Can Do

We help brands make sure every part of the customer journey performs, especially checkout. That includes integrating BNPL options in a way that fits your platform, marketing goals, and customer experience standards. If you’re not sure where your checkout is falling short, that’s where we come in. Let’s talk about what might be missing and how we can help close the gap.